Türkiye’nin Turbofan ve Turbojet Motor Projeleri

Temmuz 16, 2022

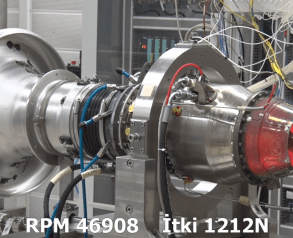

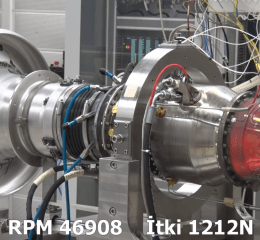

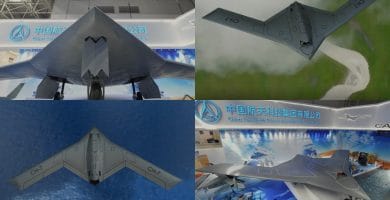

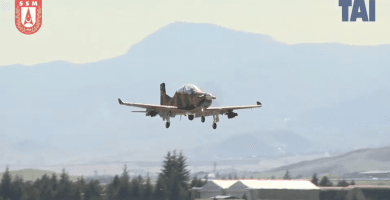

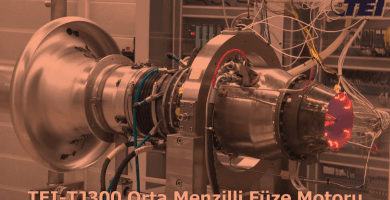

Türkiye’nin savunma ve havacılık endüstrisindeki en büyük eksikliklerinden biri olan motorlar alanında TUSAŞ Motor Sanayii …